View Post

Financial Independence Pyramid

Posted by Arnold on 04/15/15, 11:23

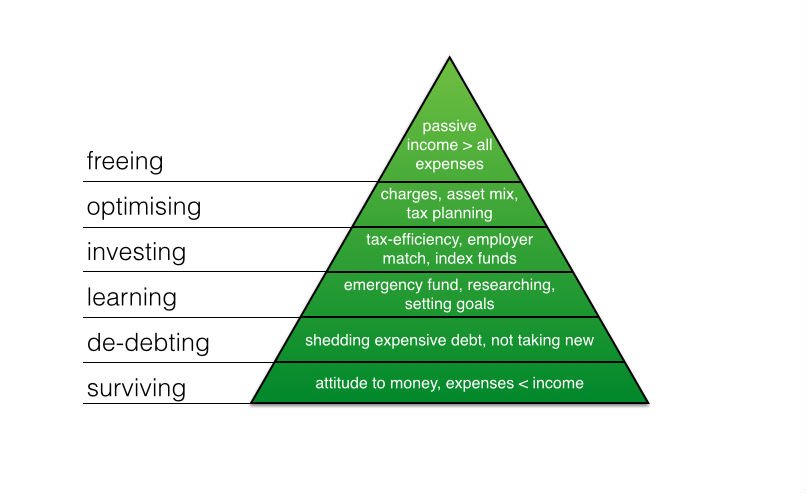

There are many paths and many steps to take on the road to financial independence. As a change of pace to describing specific things you can do to help your financial situation, the following image portrays a general path toward achieving financial independence (and possibly early retirement), presented in a pyramid form:

The pyramid comes from the (now defunct) website mistersquirrel.com, but the principles it presents still remain true. Many of the levels may overlap in scope, but just like each individual person has different financial situations, this particular approach serves only as a guide toward creating and realizing financial goals and independence. Here is a quick overview of the 6 levels of the financial independence pyramid:

- Surviving: Your attitude towards money needs to change. If you think that your finances will just take care of themselves, you are not thinking about money correctly. Getting your head out of the sand is the first step toward realizing your financial goals. At this point as well, your expenses should be less than your income if you are to make it to the next step.

- De-Debting: Once you've got the foundation for surviving down, there should begin to be more money available to start paying off your current debt. To all those bills you've ignored for so long, it's time to say "hasta la vista" (especially to those credit cards that keep growing and growing with interest). Having a clean slate will free you up for the next level of the pyramid.

- Learning: Now is the time to start looking toward the future. Set up an emergency fund for unexpected expenses so you don't slide down the pyramid. Check to see if your employer offers some sort of retirement scheme. Learn about options that will protect your savings from taxes. Research other options for investing and saving that are in line with your current situation and level of comfort in manipulating your finances. Then, set new goals using everything you have learned.

- Investing: Time to start implementing your goals! Use the information you learned to invest and save your money in the places that you've researched.

- Optimizing: Develop more long terms plans with the financial events you have already set into motion. Find better savings rates or investment opportunities to maximize your financial potential (use step 3 and 4 as often as you need to). Your nest egg won't grow without careful attention and care!

- Freeing: You made it to the top! At this point, your expenses are all covered and you have your own discretionary income. You have built a solid pyramid of financial stability, and you now have a positive and healthy attitude towards money.

There are no comments to display.

Please log in if you would like to leave a comment.